Join the most effective Forex Trading Forum for Specialist Insights and Tips

Join the most effective Forex Trading Forum for Specialist Insights and Tips

Blog Article

The Relevance of Money Exchange in Global Profession and Commerce

Currency exchange offers as the foundation of global trade and business, making it possible for smooth purchases in between diverse economies. As fluctuations in exchange rates can present considerable risks, effective money risk monitoring ends up being vital for keeping an affordable side.

Role of Money Exchange

Currency exchange plays an essential role in helping with worldwide trade by enabling deals between events running in different currencies. As services increasingly take part in global markets, the need for efficient money exchange systems ends up being vital. Currency exchange rate, which vary based upon different economic indications, determine the worth of one currency family member to one more, influencing trade dynamics considerably.

Furthermore, money exchange alleviates threats connected with foreign purchases by providing hedging options that shield against damaging currency activities. This financial device permits businesses to stabilize their prices and revenues, better advertising international trade. In recap, the duty of currency exchange is main to the functioning of worldwide business, providing the important framework for cross-border transactions and supporting financial growth worldwide.

Effect on Pricing Techniques

The systems of money exchange considerably affect prices approaches for organizations engaged in global trade. When a domestic currency reinforces against international money, imported items may come to be much less costly, enabling services to lower costs or increase market competition.

In addition, companies should take into consideration the financial problems of their target markets. Neighborhood purchasing power, rising cost of living prices, and currency stability can determine how products are valued abroad. Firms usually embrace prices strategies such as localization, where prices are tailored to every market based on currency variations and neighborhood economic elements. Additionally, vibrant prices versions might be employed to respond to real-time currency activities, guaranteeing that organizations continue to be dexterous and competitive.

Impact on Profit Margins

If the worth of that money decreases relative to the company's home money, the earnings realized from sales can diminish significantly. Conversely, if the international currency values, revenue margins can boost, boosting the total economic performance of the company.

In addition, services importing items deal with comparable risks. A decrease in the value of their home money can bring about greater prices for foreign items, ultimately pressing profit margins. This situation necessitates effective money risk management techniques, such as hedging, to mitigate possible losses.

Companies should stay vigilant in checking currency trends and readjusting their financial techniques appropriately to protect their bottom line. In summary, understanding and handling the impact of money exchange he has a good point on earnings margins is essential for businesses striving to keep success in the complex landscape of international profession.

Market Gain Access To and Competition

Browsing the complexities of global trade requires services not just to take care of profit margins however likewise to make sure effective market accessibility and improve competition. Money exchange plays a pivotal duty in this context, as it directly influences a business's capacity to get in brand-new markets and contend on an international range.

A positive currency exchange rate can decrease the expense of exporting goods, making products much more eye-catching to international customers. On the other hand, an unfavorable price can pump up rates, hindering market infiltration. Business need to purposefully take care of currency changes to maximize pricing strategies and remain competitive versus local and worldwide players.

Additionally, companies that efficiently utilize currency exchange can produce opportunities for diversification in markets with positive problems. By developing a strong visibility in several money, companies can alleviate dangers connected with reliance on a solitary market. forex trading forum. This multi-currency strategy not only improves competition but also cultivates strength in the face of economic shifts

Dangers and Challenges in Exchange

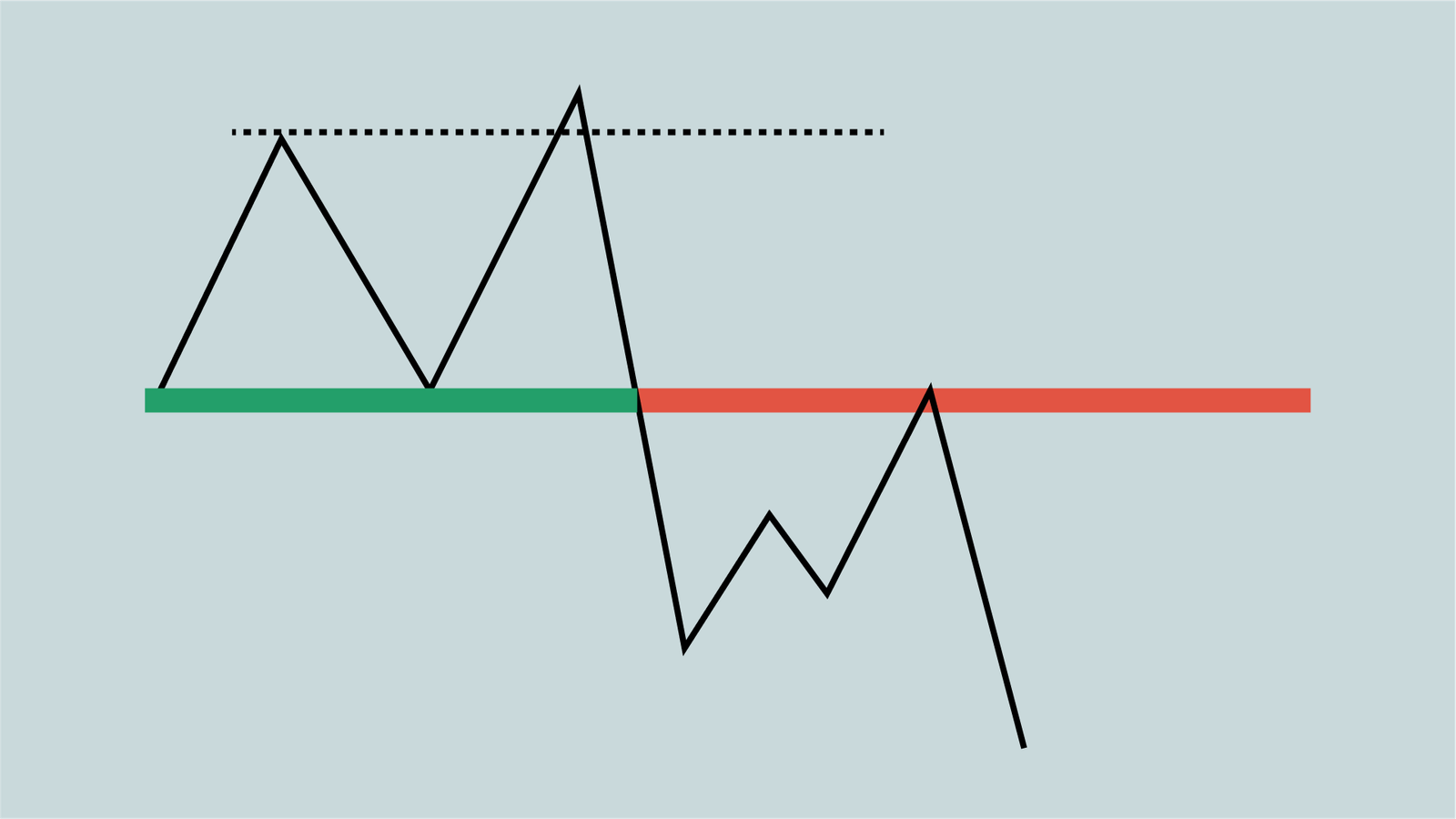

In the realm of worldwide profession, organizations deal with substantial risks and challenges connected with currency exchange that can influence their economic security and functional approaches. Among the primary dangers is currency exchange rate volatility, which can cause unforeseen losses when converting money. Variations in currency exchange rate can affect earnings margins, particularly for companies engaged in import and export tasks.

Additionally, geopolitical elements, such as political instability and regulative changes, can exacerbate currency risks. These elements may cause abrupt shifts in money worths, complicating monetary projecting and planning. Organizations should browse the intricacies of foreign exchange markets, which can be affected by macroeconomic go now signs and market view.

Conclusion

In final thought, currency exchange functions as a foundation of global profession and business, promoting purchases and boosting market liquidity. Its impact on rates approaches and revenue margins highlights the requirement for efficient money danger monitoring. In addition, the capability to browse market gain access to and competitiveness is critical for companies operating internationally. In spite of integral threats and obstacles related to changing currency exchange rate, the relevance of money exchange in cultivating financial development and durability stays obvious.

Report this page